The Organic Community Summit

June 18, 2007

Dear Organic Stakeholders,

Approximately a hundred diverse members of the extensive organic community met on Monday, June 18, in an effort to reach consensus on issues of deep concern to members of the organic movement that includes a wide range of commercial entities, consumers, advocates, and farmers. The teleconference was quickly put together in response to the highly exclusive nature of the so-called Organic Summit due to meet this week in Boulder, Colorado.

When many of us first heard of that meeting, we assumed that the term summit was indicative of an all-inclusive gathering of the whole organic industry/community. However, due to a limit on the number of participants, high fees and hotel costs, transportation expenses to Colorado (far from where the majority of organic production takes place), as well as scheduling the event during the busy farming season, it became apparent that this discussion of organics was primarily designed for business leaders and industry representatives, with just a smattering of selected community delegates. We were motivated to sponsor the Organic Community Summit when we learned that many key participants would be excluded from joining what was billed as the “new organic conversation” with "industry leaders" in Boulder.

The Community meeting featured two keynote speakers. Jim Riddle, former

National Organic Standards Board chair, said organics encompasses a

wide range of farmers, activists, academics, business people, and

regulatory personnel, and “in harmony we thrive.” He said the organic

movement has strong roots, and this is a time of great opportunity for

the whole community, as organic agriculture is best positioned to meet

today’s paramount challenges of climate change, energy use, and

sustainable food production. These issues were underscored by the

second keynoter, Fred Kirschenmann, a universally respected organic

leader and also former member of the NOSB, in the context of the

longtime organic movement, which grew out of the commitment to soil

health principles espoused by its early pioneers. He also referred to

the tension the organic community is experiencing with the

commercialization and mainstreaming of movement ideals and the need for

the entire industry to move beyond this conflict if organic is to

survive as meaningful label in the marketplace.

The remainder of the meeting was open to all the Summit participants.

Others sent comments via e-mail. Participants strongly felt that all

sectors in the organic community (farmers, advocates, consumers,

academics, public interest groups, investors, manufactures,

distributors, and retailers) are vitally important to both the economic

success and realizing the societal benefits that organic food

represents.

Maintaining genuine and meaningful organic standards was high on

everyone’s list. The organic industry is successful because of the high

esteem the consumer holds for organic food and the farmers who produce

it, as well as an authentic approach to food processing, distribution,

and retailing. There is great danger that market acceptance will

rapidly diminish if consumers perceive the integrity of organic is

being breached by business interests looking to capitalize on organics’

good name. Organic production does not mean business as usual in this

respect, but rather resides in the province of socially responsible

business.

In the coming years, climate change, energy conservation, water quality

and quantity, and food security will be the major emerging themes in

this country and around the world. How agriculture reacts to the end of

cheap energy and cheap water resources will have a profound effect on

our well-being and, through impacts of global warming, on the planet.

In all of our deliberations we need to make sure that organic food

production, processing, and distribution remain a proactive alternative

for consumers to meet these profound challenges.

Organic food also needs to remain at the forefront of offering

consumers alternatives to technologies and practices they find

environmentally destructive, a danger to their families’ health, or

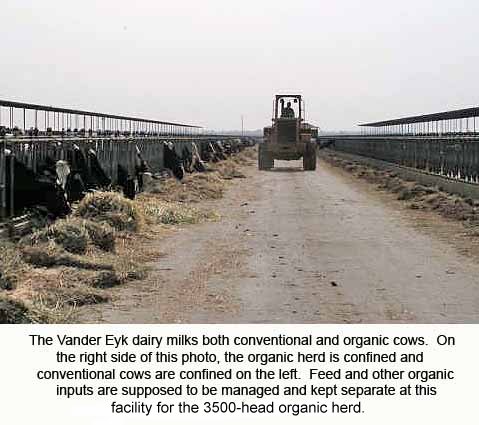

morally abhorrent. In the near term, animal cloning, genetic pollution,

livestock confinement operations, as well as the exponential growth of

imports and concomitant food safety problems will be high-profile

issues that have the potential to showcase the vastly superior organic

alternative.

To keep organics healthy, other important issues will also need to be

addressed. There is wide concern that smaller farmers and processors

are being squeezed out in terms of distribution opportunities and

escalating costs at the USDA for certification. Also, aggressive action

is needed to recruit and train new, young farmers to take the place of

retiring organic producers and to meet increasing demand for organic

commodities—domestically. The word local needs to be respected and

continued to be associated with organics. Shipping food around the

country, or around the world, does not conform to the expectation of

the organic consumer. And more needs to be done to facilitate market

access by smaller, dedicated farmers, who are held in high esteem by

the consumers. These family-scale farmers are the "face of organics”!

Overall, we need a greater level of transparency, both in the processes

and ingredients used to manufacture organic food and in the oversight

of our industry by the USDA. At the same time, the National Organic

Program needs a much higher level of funding, as does organic research.

Industry clout could be a positive force for change at the political

level to support and expand all aspects of organic agriculture.

In closing, we need to move toward a unified industry. The fact that we

felt compelled to hold a Community Summit in the same week that

industry interests were holding their Summit is counterproductive and a

loss of a great opportunity to join experienced and passionate people

in the common goal of furthering the organic movement. This message,

and our gathering, were not intended to be "anticorporate." We

absolutely welcome corporate investors into the organic market. Their

capital and expertise have broadened both product offerings and

distribution and are an integral part of organics’ success. But, the

commercial sector needs to carefully consider the long-term

implications of not respecting the high standards created by the

organic community/industry. If we lose the integrity of the organic

standards, we will rapidly lose organics’ preeminence in the

marketplace.

We all look forward to future meetings that are truly legitimate

gatherings of the entire organic community. Together, we can ensure

that organic food and farming offer healthy returns to farmers and

investors, respectful employment to all those involved in such an

important enterprise, respect for the Earth, a productive, sustainable,

safe, and nutritionally rich food supply that meets modern energy and

climate challenges, and a positive “green” model for society.

Sincerely yours, on behalf of all those who participated in Monday's Organic Community Summit,

Barth Anderson

The Wedge Co-op

The nation's largest single-store natural foods cooperative

Dave Engel

Certified organic dairy farmer

Natures International Certification Services

Ronnie Cummins

Organic Consumers Association

Steven Heim

Expert in corporate responsibility and ethical investing

Boston Common Asset Management

Steve Gilman

New York Organic Farming Activist

Michael Potter, CEO

Eden Foods

Ken Rabas

Farmers All-Natural Creamery

Mark Kastel

The Cornucopia Institute

Trudy Bialic

PCC Natural Markets

The nation’s largest consumer-owned grocery Cooperative

Goldie Caughlan

PCC Natural Markets

Former member: National Organic Standards Board

Organizations listed are for identification purposes only

A fascinating

A fascinating